This is good news for people who are filing multiple years late in the Streamline programme. The IRS may take so long to process your case that the statute of limitations could expire before they can deny your acceptance into the programme. https://www.washingtonpost.com/opinions… … Read More

If you’re wondering why you haven’t received your refund or why the IRS hasn’t replied to our letters yet, this should give you some idea of what’s causing the delay. We can’t speed it up, but we can help! … Read More

It is with great sadness that we let you know Phil Hawkins, EA passed away on Sunday. He has been a valued and much loved member of our team, working hard right up through February before he took too ill to continue. He will be sorely missed. … Read More

Come to a basic class in taxes for Americans abroad. I’ll be talking about the Streamline Offshore Filing programme. https://www.democratsabroad.org/dauk_tax_committee_presents_expat_taxes_101 … Read More

Everyone has tax questions and sometimes you’re afraid to ask them. Ask them anonymously at the next DAUK Tax Committee Zoom seminar. To ask, just sign up before the seminar and send your question. Then log in to the seminar and your question is answered. Since we don’t know who asked what question, you get… Read More

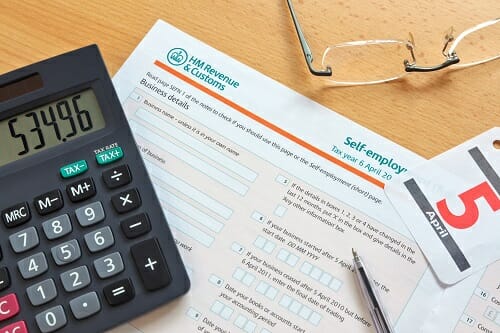

With its long-standing global position and English-speaking culture, the United Kingdom is a popular destination for American expats. Among many things to consider when living and working in the UK, however, is how UK tax will affect US citizens. Her Majesty Revenue & Customs HMRC is the United Kingdom’s equivalent to the IRS. Its primary… Read More

In the UK taxation system, the term ‘domicile’ defines a long-term intention for residency in the United Kingdom. Whether US expats and their family members voluntarily or involuntarily gained the UK domicile status, it is important when determining their future and current UK IHT tax exposures. If US expats are domiciling in the UK, their… Read More

Understanding tax allowances, deductions, and refunds for American expats living in the UK can be difficult without the help of an expert tax advisor. Common mistakes when filing taxes can be costly and they could delay payments. The basic allowance for taxpayers in 2021-2022 is £12,570 which means that there will be an income tax… Read More

The US government requires its citizens to pay tax for their international income even if they have gained permanent resident status in another country. Fortunately, there are some special provisions that protect US national from double taxation: Foreign Earned Income Exclusion – expats should take advantage of the Foreign Earned Income Exclusion to reduce taxable… Read More

Wow, look what Liz wrote in the American Expat Financial News Journal! Based on current market reports, she takes an in-depth look at what Americans selling their homes in the UK need to know about cap gains tax. Many American expats don’t know that they must pay capital gains tax when they sell their homes… Read More